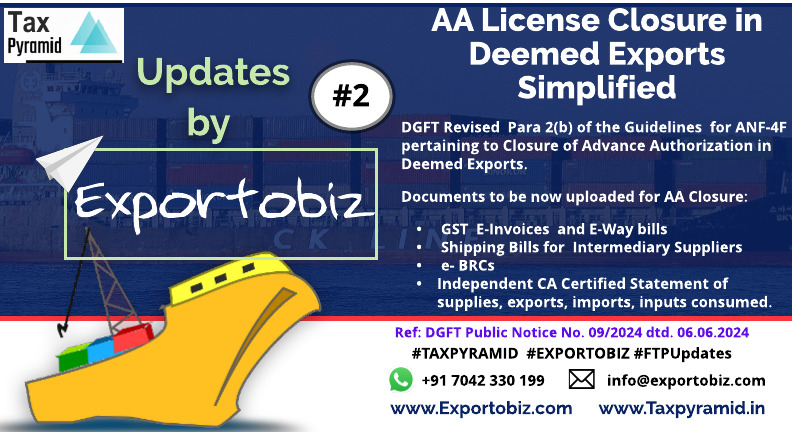

In a significant move to reduce compliance burden on importers, the DGFT has revised Para 2(b) of the Guidelines for Applicants under ANF-4F of the Handbook of Procedures 2023 pertaining to Closure of Advance Authorisation obtained in case of Deemed Exports.

New Delhi, June 2024 – The Directorate General of Foreign Trade (DGFT) has announced an amendment to the Foreign Trade Policy 2023 to streamline the closure process for Advance Authorisations, obtained for deemed exports. This amendment aims to make the process more straightforward and reduce the documentation required from exporters.

The Revised Para 2(b) of the Guidelines for Applicants under ANF-4F which specifies the documents to be uploaded along with the application for Closure of Advance Authorisation, now includes:

- GST e-Invoices and e-Way Bills: Exporters can now provide system-generated GST e-invoices and corresponding e-way bills. If unavailable, a copy of invoices or a certified statement of invoices is acceptable.

- Shipping Bills for Intermediate Suppliers: When products are supplied by an intermediate supplier directly to the port for export, a shipping bill with the domestic supplier’s name, endorsed with the authorisation numbers of both the ultimate exporter and the intermediate supplier, is required.

- e-BRCs: Submission of Electronic Bank Realisation Certificates is mandatory.

- Certified Statements by CA: Exporters must provide a statement of supplies, exports, imports, and actual consumption of inputs in exported items, certified by an Independent Chartered Accountant.

Impact of the Change:

This change aims to simplify the procedure and reduce the compliance burden for applying for Export Obligation Discharge Certificate (EODC) in the case of deemed exports.